I remember the day my parents waved goodbye after helping me unload furniture in my first apartment. That moment of being completely on your own was a wake-up call. It was time to be an adult! I unloaded groceries, unpacked my few items and began planning. This plan was filled with attending undergraduate classes in the morning. In the afternoon and during the weekends, I worked my full-time job. At night, I served tables. Nights that I was not scheduled to serve tables, I tutored chemistry and algebra. If I had any spare hours during the weekends, I worked on a ranch, painting fences, cutting mesquite trees and exercising horses. Studying and homework? Well, that happened bright and early in the morning before school. Yes, that was my schedule.

A tad overwhelming, and I do not recommend that to anyone, but it allowed me to live and pay for college. That was my objective at the time. Whether you work or not when in college, there is a way to be smart about your money now and give yourself a headstart. Less debt and more savings at a younger age is key to a happy retirement because time is in your favor. But, of course, who’s thinking about retirement when they are still in college? Well, this thought needs to cross our minds now, because Social Security is not going to save us.

Being smart and diligent with money while still young is not rocket science. After all, is budgeting really that hard? Is simple math really that hard? Is learning a few finance 101 topics really that hard? No, not at all. What’s really difficult is the follow-through and the mindset. Many think that finances are something that can be handled later on in life. The few who do take the right steps early will be so much further ahead.

Let’s dive into some Finance 101:

Let’s dive into some Finance 101:

1. “Nobody is too busy, it’s just a matter of priorities.”

This must be of utmost importance; do whatever you have to do, but make your personal finance your major priority.

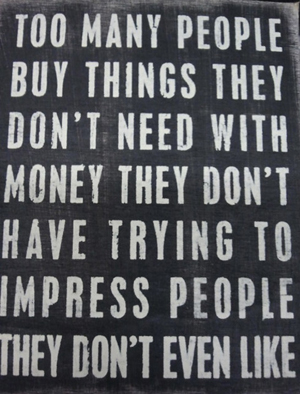

2. “Don’t go broke trying to look rich. Act your wage.”

Live within your means. Yes, the new freedom you now have is full of money-spending opportunities, but be wise in your selection of ways to spend.

3. “It’s not your salary that makes you rich, it’s your spending habits.”

Prioritize your income. Use the 50/30/20 rule, but for you in college 50/20/30; the general rule is 50 percent on expenses, 30 percent on wants and 20 percent on savings. Well, while in college, be a little more aggressive on the savings for an emergency fund and paying off school loans. So for you, 50 percent expenses, 30 percent savings, 20 percent wants. (Maybe even lower on the wants!)

4. “If you want something, go get it!”

If you want something, you either have the money, or you don’t buy! Don’t get sucked into all the different payment plans and incentives.

5. “Beware of little expenses: a small leak will sink a great ship.”

It may be fun to eat out, but it will add up. Set some rules for yourself and try to eat as much at home as possible. Be smart with grocery shopping.

6. “A budget is telling your money where to go instead of wondering where it went.”

Budget and track. Find a way that works for you. Apps, spreadsheet, pen and paper, any way.

7. “An investment in knowledge pays the best interest.”

I know you’re in college to gain knowledge in various subjects and the last thing you need is more knowledge that has nothing to do with your classes. It is important, though, for you to just be aware of the impact your financial habits have on your future.

This is all about self-discipline and diligence. Time flies very quickly, and before you know it, you are in that phase where college is complete and you are building your career. Wouldn’t you rather be as far ahead as possible instead of being weighed down by debt and less-than-ideal choices?

I love this quote, which is appropriate for summing up the subject: “Today’s pain is tomorrow’s power. The more you suffer today, the stronger you are tomorrow.”