National Estate Planning Awareness Week is coming up Oct. 16–22; this week was created in 2008 to promote public awareness of this crucial area of overall financial well-being. According to the National Association of Estate Planners & Councils, it is estimated that over half of all Americans do not have an up-to-date estate plan.

It is a popular misconception that estates and estate planning are only needed for extremely wealthy people—this is not true! In the past, many families were driven to estate planning solutions to avoid adverse tax consequence. For example, in 2000, the federal estate tax exemption was only $675,000, but currently in 2017 the exemption for an individual is $5.49 million and $10.98 million for a couple.

Regardless of whether you are affected by the federal estate tax or not, you will always need the basics when it comes to estate planning. The basics of estate planning include establishing financial and medical powers of attorneys to make decisions if you cannot, and deciding who will receive your assets, retirement benefits, home or even proceeds from a life insurance policy upon your death. There are certain documents that you should consider regardless of your health, wealth and age:

1. Durable Power of Attorney – This authorizes someone to act on your behalf in the event that you become physically or mentally incompetent and unable to handle financial matters. The person you designate in the durable power of attorney can pay bills, file taxes, direct investments, etc. on your behalf.

2. Medical Power of Attorney/Directives – These allow you to specify the medical treatments you desire in the event you cannot express your wishes and it appoints someone specifically to make decisions for you.

3. Will – The will is the core of any estate plan, and it distributes your property as you desire after your death. If you die without a will, then you would be legally deemed intestate and, consequently, disbursements are made according to Tennessee’s intestate laws, which might not align with your wishes. In addition, a will names an executor to manage and settle your estate administration.

Additionally, you may also want to include in your will who you desire to care for your children upon your death.

There is also the issue of timing and your ability to stipulate when your beneficiaries can access any assets you choose to pass to them. For instance, you may not want a young adult to receive their entire inheritance all at once, and if that is the case, then you definitely need trust planning, particularly if any of your children have special needs.

Finally, because wills, trusts and power of attorneys are legal documents, it is crucial that they be well written and properly executed under Tennessee Law by a licensed attorney who specializes in this very technical area of the law.

~~~

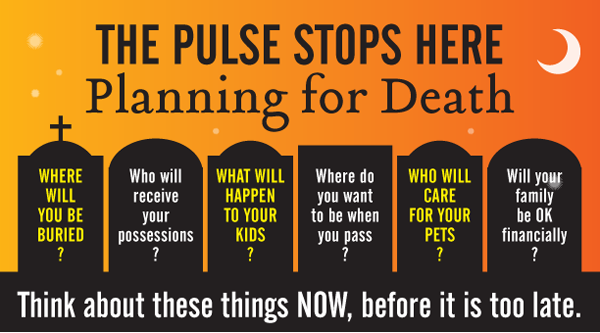

In anticipation of National Estate Planning Awareness Week and in an effort to help the people of Murfreesboro better plan for death, the Murfreesboro Pulse, attorney Ashley Stearns and Cultivate Coworking will present a night where area residents can come and consider such issues in a comfortable, casual atmosphere.

Held Oct. 12 at Cultivate Coworking, the event is free to attend, but a limited number of spots will be available. Wine and refreshments will be served.

Join representatives from Alive Hospice, the Alzheimer’s Association, financial institutions, funeral homes, attorneys, a notary and other death-related organizations.

“Powers of attorney and healthcare directives contain important instructions for the last years of life and allow you to name a trusted individual to oversee your care and financial affairs. The consequences of not having these documents in place can be costly and burdensome to your family,” according to Murfreesboro attorney Ashley Stearns. “Additionally, estate planning through wills and trusts is essential and allows you to customize plans for the distribution of your assets, provide for your chosen beneficiaries and choose who will oversee your estate administration.”

The Pulse Stops Here: Planning for Death

Thursday, Oct. 12, 2017

6–8 p.m.

Cultivate Coworking, 107 W. Lytle St., Murfreesboro

Topics include:

– Wills

– Power of Attorney

– Healthcare Directive

– Life Insurance

– Emergency Planning

– Social Media “Digital Legacy”

and more