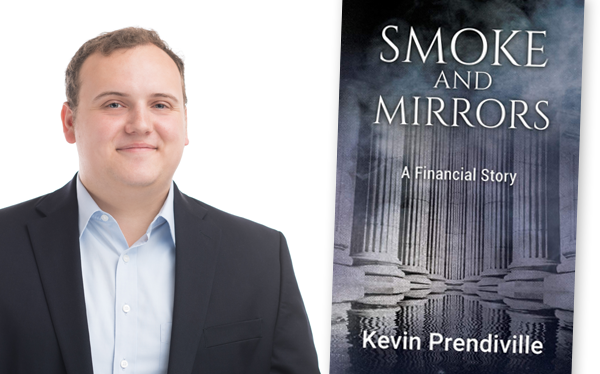

Kevin Prendiville, owner of the company Financial Transitions, works with investor clients in Middle Tennessee and has recently written a book on financial freedom called Smoke and Mirrors.

In his book, he encourages others to maximize their wealth and harness the power of compound interest, he explains what financial freedom is and then he reveals many financial myths.

“My goal is not to promise riches or a flashy get-rich-quick scheme, but to reinvigorate the idea that America is our land of opportunity,” he writes. The author, who wants others to expand their view of wealth building, says he aims to “dispel the biggest financial myths in the industry today.”

“I know that you can identify for yourself tens of thousands of dollars that all of us are unknowingly and unnecessarily sending away to the federal government, financial institutions and Wall Street,” Prendiville writes in Smoke and Mirrors.

He said he believes people shouldn’t have to jump through a lot of hoops to have access to their money, but unfortunately there is often red tape surrounding one’s money as soon as it is placed in a financial product or banking solution. In Smoke and Mirrors, he discusses how this is done by banks, other financial institutions and the federal government.

In a quest to free up peoples’ money and increase their wealth, Prendiville explains the concepts of wealth control, opportunity cost, compound wealth, inflation, accumulated wealth, transferred wealth, the circle of wealth, collateralization and the use of other peoples’ money (OPM).

He also discusses debt, and the idea of a debt-free lifestyle as he poses the question: “Is our objective to have more money, or is it to be debt-free?”

In an interview with the Murfreesboro Pulse, Prendiville talked about his mission and about wealth building.

“I believe that true freedom begins with financial freedom,” he said. “I help educate on how, unknowingly and unnecessarily, we are giving money to a number of different institutions,” he said. “Knowing this, we can build better, stronger, more usable wealth. One of things I touch on is how where our money may actually be can be more important than what it can earn us in terms of percentages.

“It’s not just a strategy of getting 12 versus 8 percent, it is having access to the money that you have already earned,” he said. “We are very blessed in this country in the sense that a lot of us know how to make money, whether it is working with a skill, working with our minds, working with our hands. The problem is maximizing our own money that we have earned. That is the essence of the education that I look to provide all of my clients with and the reason behind Smoke and Mirrors.”

Prendiville emphasizes three building blocks when it comes to wealth.

“One objective is to minimize opportunity cost. Opportunity cost is the basic measure of how much money you’ve lost by making one decision. This comes into effect obviously when we borrow money from an institution. We are doing something as simple as buying a car and we transfer our wealth to an institution, a bank for instance, and the money that we spend on that asset will never again be able to be used for our advantage. That’s because the money that could have been invested in—even if you calculate the average market rate of return against what that cost was over the 10, 15, 20, 30 years—it ends up being a much larger number than what we end up actually spending. And the same principle applies when we pay for something with cash, which is why I’m not a proponent of being completely debt-free.

“I think that is a bit of a fallacy because when you pay for something with cash, the opportunity cost still applies,” Prendiville said. He asks consumers to consider the idea of taking out a loan on a car, for example, and then compare the total amount spent to the total amount their invested money would yield if it had been allowed to continue to compound in their favor.

“The next principle is uninterrupted compound interest, and this is what Albert Einstein called the Eighth Wonder of the World. It works on an exponential curve and the basic principles that money will continue to compound on itself and will essentially build momentum the longer it stays accumulating.”

Whenever the compound effect on your money stops, like when there is a market crash or when you go and take money out to pay for something with cash, for instance, Prendiville explains, then the compound effect stops and it has to restart.

“So, if you are already 15 years in accumulating interest and then you take money out or the market crashes and it comes to a dead stop, now it’s going to have to rebuild that momentum and in 15 years you will be nowhere near where you would have been [with uninterrupted interest].”

The final principle is the principle of other peoples’ money—or “OPM.”

The way you maximize this is by borrowing against an appreciating asset, and there are many different ways that you can do this. This is how you look at debt differently. While there are certain types of debt that you definitely want to be wary of that will sink a financial plan, there is also a bit of debt known as good debt and that is usually measured by using debt in order to purchase an appreciating asset. So if I had an account that was compounding and I borrowed against it because I am using other peoples’ money, I am not taking from the account and I’m not contributing to my opportunity cost.”

The consumer can then use that borrowed money to buy an asset—real estate or to buy a business or to get in the stock market.

“I can use the profits from that asset to pay down the loan on my appreciating asset, and once I’ve cleared that debt I have two assets: one that has continued to compound for the whole time and the other one that is just beginning on its journey,” Prendiville says. “I have two assets, I have not contributed to opportunity costs and I have allowed compound interest to begin to take effect in the new asset and to continue without interruption in my original asset.”

For those who want assistance with their finances, and further explanation of these principles, Financial Transitions offers three main services: cash flow mapping, which serves business owners and individuals by taking a look at where where money is being allocated and maximizing the amount of cash flow; basic disabilities coverage, offered for small businesses because, Prendiville says, the number-one reason people with wealth die without it is because they become disabled and have to draw from the money they have; and private reserve strategy, offered for both business owners and individuals, essentially enabling people’s money to work for them similar to how it works for the banks. Private reserve means you aren’t transferring wealth to different institutions, and you are able to maximize your uninterrupted compound interest and minimize your opportunity costs.

___

For more information, contact Kevin Prendiville at 978-501-2236, visit kevinprendiville.com or find Smoke and Mirrors on Amazon.