Have you ever pondered this question that’s often whispered in financial circles: “Would you rather have a pile of cash now or a steady stream of income for life?”

In simpler terms, imagine holding $100,000 in your hand today or receiving a guaranteed $2,000 every month until your final breath.

Both options come with their own set of advantages and drawbacks, and the “correct” choice depends heavily on your unique circumstances and risk tolerance. Let’s delve into the factors that might sway you towards one option over the other.

The Age Factor:

Imagine you’re 80 years old. Receiving $2,000 per month sounds like the safe choice, but if you live for just three more years, you’ll only collect $72,000 before departing this world. In that case, the $100,000 lump sum suddenly seems more appealing, allowing you to spend comfortably and leave something for your loved ones.

Now, picture yourself as a vibrant 20-year-old. With a considerable life expectancy, the $2,000/month option holds immense promise, potentially amassing $1.4 million over your lifetime without considering any investment income you can earn on that money. As we can see, the same question results in two vastly different perspectives.

Market Volatility:

Let’s say you decide to choose the lump sum and invest it in the stock market. The next day, a brutal recession strikes, slashing your $100,000 investment down to $60,000. If you’re 80, you might kick yourself for not taking the guaranteed monthly income. However, at 20, you’ll likely weather the storm, knowing that the market has a history of recovering and potentially multiplying your wealth over the years. No matter which end of the age spectrum you are on, however, you are not living your happiest day when you see that your account has dropped by $40,000.

Risk Tolerance:

Your appetite for risk plays a crucial role in this decision. If you already possess a sizable fortune, a $100,000 investment might feel like a small gamble, potentially fueling aggressive tactics to maximize returns. Conversely, if that $100,000 represents your nest egg, preserving capital becomes paramount, leading you towards more conservative strategies. In this case, you might choose one or the other, depending on how it impacts your life and what you might be able to do with the money.

The Retirement Conundrum:

As a financial advisor, this question pops up frequently, especially during retirement or job changes. Companies often offer retirees the choice between a lump sum payout or a monthly pension. Similarly, individuals might consider exchanging a lump sum for an annuity’s guaranteed income stream.

My approach to this dilemma involves calculating potential scenarios. Assuming a reasonable yet conservative return on investment (5%, for example), I project how the lump sum would grow over time while factoring in regular withdrawals for living expenses. This is then compared to the guaranteed monthly income, identifying the point at which the annuity becomes more beneficial and when the lump sum would potentially deplete.

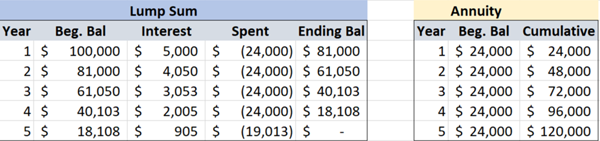

For instance, a $100,000 investment earning $5,000 annually (5%) in interest would run out of money in the fifth year compared to a $2,000 monthly income. The table below illustrates this scenario, in which the lump sum would be exhausted in year 5, while the annuity would have accumulated $120,000 by that time. Even if you were to earn 6% on the lump sum, the result would still be a depleted balance at the end of year 5.

Remember, this is just one example, and the annuity might not always be the superior option. If, in this case, the investor passed away after year 2, they would have only received $48,000 from the annuity, while the $61,050 remaining in the lump sum could have been left to their loved ones. Many annuities and pensions only pay out for the life of the owner, but if the one you have offers other options, those need to be factored in.

Life’s Uncertainties and Seeking Guidance:

Life throws curveballs, making financial planning a complex puzzle. That’s where seeking professional guidance from a financial advisor can prove invaluable. By analyzing your specific circumstances, risk tolerance and long-term goals, an advisor can help you navigate this trade-off and make an informed decision that aligns with your unique needs.

(Disclaimer: The information in this article is not tax, legal or financial advice. Each person’s financial situation is different and an educated analysis is required to make the right decision.)