Even after reducing consumption to an elegant minimum, the conscious consumer is inevitably left with a seemingly unending number of choices. Were the raw materials for the product ethically sourced? How far did the item travel to reach this shelf? Are the workers paid a living wage? In the perpetual pursuit of a conscious path—and it is indeed a path; I am not convinced that we can ever get ‘there’—it seems to me that one crucial factor remains peculiarly absent. That factor is personal financing. Say for example you earn $100 cash on a particular day and that after work you agonize about how to spend $5 on the most ethical, local, and organic tomatoes at the farmer’s market. You then place that warm red bounty of summer in your bike basket and pedal to the branch of a national bank chain to deposit the remaining $95. As a safe investor, you decide to invest $20 in that bank’s mutual fund offering. At the end of that day 95 percent of your financial power is stored at or invested with an institution that is legally beholden to shareholders, and that is certainly invested in high return petrochemical, agribusiness, pharmaceutical and weapons companies, while 5 percent of your financial power goes toward a local, fairly paid farm worker who doesn’t pollute your city’s water supply. That agonizing decision, although important, has in a sense bought off your conscience.

What you are worth in savings plus what you might owe on a mortgage or other form of debt likely outweighs the sum of painstaking individual choices from an ethical standpoint. For the majority of us the monetary medium, as fictitious as it is valuable, is held in a profit-earning institution. Banks are rarely described this way. They are simply a part of life, providing a financial mechanism to purchase items over a long period of time on credit, or are a place to earn money with money in the form of interest. As a financial tool this system can be valuable for both the borrower and the lender, and is in fact the driving force of a consumption-based economy. The idea of ethical banking, however, never seems to enter the equation. Even the pairing of those two words should merit a second glance, so divorced from another are the concepts in our modern understanding.

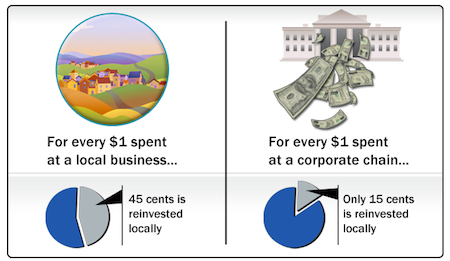

The idea that a bank should, like all other institutions, be beholden to some type of ethical code gained widespread attention during the 2007-2008 financial crisis. It was revealed during this time, although not for the first time, that the largest banks are on par with the largest corporations in their ruthless zeal to return the highest margin, whatever the risk to society. There is thankfully another financial model, based not on profit to shareholders, but on community values. A credit union is by definition nonprofit and member-owned. Credit unions are democratically run by an elected board to whom the CEO reports. Financial benefits include lower fees and strong ties to the local economy, which are benefits also offered by local community banks. It is a widely cited statistic that local banks and credit unions fund over half of small business growth while accounting for under a quarter of national banking assets. Larger banking institutions, say on the Bank of America level, operate on a model analogous to the fast food industry. Branch locations extract wealth from local communities and transfer it out of the community.

Another important financial issue is non-insured assets. Financial assets insured by the FDIC, such as standard checking and savings accounts, have to play by certain rules, one of which is avoiding speculative and risky investments such as the stock market. If you choose to invest in mutual funds, or if your company chooses for you in the form of a 401k plan, you are gambling on a higher rate of return by making uninsured investments in a variety of markets. This is not inherently unethical, but as they say, the devil is in the details. The petrochemical, agribusiness, pharmaceutical and weapons industries are all immensely profitable ventures in our current way of valuing goods, and it would be impossible for an ethical investor to choose such companies. It would also be very unlikely that the customer in the opening paragraph would choose those types of companies if there was a clear choice. Making high-return investments is however the sole aim of the company offering the 401k plan. Mutual funds are a prime example of how a citizen striving to make ethical choices can have a large portion of their financial assets invested unethically. In this context, the relatively minuscule amount spent on fair trade chocolate may ease the conscience, but does little to effect true change. A good analogy is recycling—some avid recyclers are also the highest-volume and most wasteful consumers. Recycling in these cases provides a fictitious boon for the conscience while the consumer continues to devour the planet.

Now that the problem has been identified, let’s look forward to solutions. The first step is to move your money (see moveyourmoney.org for the movement). If you bank at a national financial institution, move your assets, all of them, and let them know why. By ‘them’ I do not mean the nice teller who is equally taken advantage of, and who will certainly have no idea what you are talking about. There are multiple credit unions in the ‘Boro including Ascend, Heritage South and Cornerstone Financial. I recently opened an account with U.S. Community Credit Union in Nashville, partly as a result of doing research for this article. Secondly, if you are invested in a company retirement program or with personal assets, investigate just how those assets are invested. Don’t be shy when you change plans—it is a real opportunity to get a decision maker’s attention, no matter how strangely the mid-level worker looks at you. Vanguard, the company who administers my company’s 401k program, offers Socially Responsible Investments (SRIs) as a mutual fund option. There is typically a group responsible for determining the plan’s options to employees, and if you ask around it isn’t hard to find the right contact.

Understanding the banking system is anything but simple. But for anyone concerned with true change, as opposed to superficially appeasing the conscience, it is a must. The usual ‘what difference can I make?’ feeling will undoubtedly creep in, but I would encourage you with this: it doesn’t take 50 percent of people moving their assets for change to happen. Competition is stiff among financial service providers, and even a small drop in business because of a clear issue can get things moving.

Have any advice or experience with local credit unions or banks? Let the Pulse hear about it!