Let’s be real—while 2021 was better than 2020 for many people, 2021 was still a difficult year for others. I know numerous people who lost or quit their jobs due to the vaccine mandates. A job change can make for a lot of difficult life choices and changes.

Rather than spending time on the hot topic of vaccine mandates and COVID—I’ll let you do your own research and figure those things out for yourself—planning for your future is a must for all who want to move in a positive direction in 2022.

Audit Your 2021

You can’t really create a plan if you don’t know where you stand. How did you do in 2021? Did you waste too much money? Did you waste too much time? Regardless whether you used a budget in 2021 or not, it’s a good idea to do an audit to see how you spent your money and your time.

Audit Your Time

As a parent and a spouse, I’m constantly having conversations with the family about things they need or want to do. “I don’t have time,” is a standard comment, to which I reply, “You always have time to do the things you want to do. Just manage your time better.” The same applies for me. I know there are many things I need to get done around the house. No excuses. I just need to manage my time better.

When you audit your time, first hit the big blocks of time. You don’t need to recall every minute of every day. Just hit the bigger things where you might have mismanaged your time. In the past, movies and video games have been big problems for me. When I first became a Netflix subscriber, I would receive DVDs via mail and watch them immediately and mail them back the next day. I watched 6–10 movies a week! Video games were an even bigger problem for me. Just ask my wife!

How you spend your time is a big contributor to your future failure or success in life.

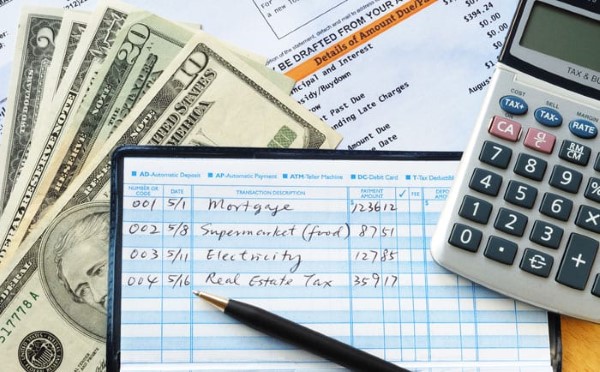

Audit Your Money

There’s a good chance everyone lets some money slip through their fingers. We all develop bad money habits. Before planning ahead, spend some time reviewing where all your money went in 2021. You’ll probably discover a few areas where you spent money that you could have invested and multiplied.

Eating out is one of the big areas for myself and my family; it costs three to four times more to eat out than to eat at home! Normally, the meals we make at home are as good or better than what we eat at the restaurants—not to mention the bonding time in the kitchen with the family. We usually cook in teams of two or three.

Next up on the list is impulse buying. My wife and I are a bit guilty of it, and it’s amazing how fast items can add up at $10 to $20, or even $100. And it’s quite easy for both a husband and wife to impulse-buy a $100 item each week if you’re not careful. That’s $800 a month on things you probably don’t even need in the long term!

Though, we’re pretty good on being frugal where the kids are concerned. If your kids want something, make them buy it!

When auditing money, identify the big buckets of spending first. Some of those are:

Housing

Insurance

Food

Eating out (treat this as a different category)

Entertainment

Vacation

Big-item spending (car, boat, furniture, etc.)

Medical expenses

Investments

Giving

Once you cover those groups and any others you think necessary, you can compare that to your income to see how well you’ve done overall. There are times when I’ve felt I did a poor job with my money in a year, but doing the audit helped me realize I had done a good job. Of course there were areas I could have done better, but don’t sweat the small stuff too much. It’s all about forward momentum.

Planning for 2022

Remember, the best-laid plans are often going to change. You just need a decent blueprint to get things moving in the right direction. Less waste. More growth. 2022 should be a year where your time helps build your health, relationships, career, finances and builds you spiritually.

Maximize Your Time

To maximize your time, do two simple things: 1) Minimize your time wasters, and 2) Pick out some things that will move your life forward.

Figure out the things that are sucking up big blocks of your time and cut those back to reasonable amounts. For 2021, I totally gave up video games and cut back on entertainment by 90 percent. At other times in my life I throttled both of those down, but not as drastically as I have done in 2021.

Warning: As I discovered, once you start reducing or eliminating your time wasters, new or past time wasters will emerge to try to replace them. Once you’ve done the hard work of cutting your time wasters, make sure you use the time for something productive.

Manage and Multiply Your Money

It’s been my experience that if you don’t have a plan for your money, it mysteriously disappears. Even worse, it can also bring you some debt.

Financial plans don’t have to be complicated. A few simple changes to your money habits can get you on the right track. At the age of 25, not only had I spent 100 percent of my paycheck, I had overspent my paycheck by $16,000! I spent 40 percent more than I made that year and would need to pay on that debt for the next four years. I had borrowed against my future and the banks/lenders benefited from my stupidity.

To correct my situation, my financial plan was pretty simple; I looked at three things:

How much income did I have?

How much debt did I need to pay off?

How much could I invest, and where should I invest it?

I was netting about $3,000 per month after taxes. My plan was very simple.

Live on $1,000 per month ($200 to my parents for rent)

$1,000 per month for debt payoff

$1,000 per month for investing ($500 for stocks, $500 for mutual funds)

Income: How can you boost your income? A $10,000 boost is a good goal for your first year. What can you make, sell or earn? Many try direct sales companies like Melaleuca, a side hustle that people I’ve known have used to quickly raise their income $500 or even as much as $2,500 per month. My wife is learning how to do woodworking and will try her hand making bowls and other things. Whatever you choose, shift your mindset to growing your income.

Debt: It’s always a good idea to lower your debt. By lowering your debt, you’re lowering your financial risks and raising your family’s security. However, some people believe in good debt vs. bad debt. Personally, I’m a no-debt guy. Being debt-free brings a lot of security.

However, many of the wealthiest people in the world use leverage debt to build wealth. But if you’re going to use debt or leverage as part of your financial plan, understand the risks. Everyone loves leverage . . . until the system turns on them and they lose. When the economy down-turned in 2008, many leveraged people filed bankruptcy.

How much debt should you or can you pay off this year?

Note: While paying off debt can be very attractive, and is an important part of your annual financial planning, consider the opportunity cost of your money. Money tied up in paying off a house debt at 2–4 percent could be invested in something delivering 10–20 percent annual returns. That’s a 6–18 percent growth in your money and you could always sell the investments if you needed to service your debt, pay medical expenses or something else.

Investing: If you want to break free financially and build some wealth, you have to develop your money mindset to an abundance mindset. Instead of spending your money on various things, train your mind to think about how to multiply your money first. With each new dollar you make, think about where you should put it so that it can grow.

How much of your income can you invest? 10 percent? 20 percent? 30 percent? Wealth-minded people think about how they can invest more of their money. They know that every dollar invested will multiply itself several times.

Invest at the level of your current competency, but also grow your competency. If you’re a new investor, good options include mutual funds, index funds or dividends stocks. Making sure your 401(k) or IRA are fully funded are also good ideas.

It’s good to diversify your investments. Some financial advisors will tell you that mutual-fund investing is diversification, and it is a diversification across stocks, but your money is still in the stock market. It’s not diversified out of the stock market.

Diversification beyond the stock market and mutual funds can include venture capital companies, cryptocurrencies, gold and silver. Real estate investing has proven to be reliable for thousands of years, and it will continue to be a good investment for thousands of years. You can start with a REIT (real estate investment trust), real estate syndication, Air BNB, or even pull a group of friends together and jointly buy a property for renting or for flipping.

In 2022, set some big investing goals. What would it look like for you to increase your investing to $20,000, $30,000, $50,000, $100,000 or more this year?

I believe 2022 can be an amazing year!