When I turned 16, I wanted a car, just like pretty much every other American teenage boy. When I asked my father for financial help getting my first car, he told me that if I didn’t get the money myself, I wouldn’t value the car. I didn’t like that answer, but as Thomas Paine said in The American Crisis, “What we obtain too cheap, we esteem too lightly.”

It turns out my father was wise to make me work for my first car.

We are not here today to talk about teenagers and their cars, but of the trillions of dollars the United States spends each and every year. First, we should ask if our employees in Washington, D.C. are spending our money wisely or, like spoiled rich brats, are they treating our hard-earned cash like Monopoly money?

Once we answer that, the next obvious question is, do we cut up Uncle Sam’s credit cards before all 330 million of us are bankrupt?

Federal Finances 101

If we’re going to talk about money and the federal government, we need to start at the beginning, with the Constitution and the powers delegated to the United States.

The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States;

To borrow Money on the credit of the United States;

– U.S. Constitution, Article I, Section 8, Clauses 1 and 2

Congress has the power to lay and collect taxes, duties, imposts and excises, but only for three specific purposes:

– Pay the debts of the United States

– Provide for the common defense of the United States

– For the general welfare of the United States

Congress also has the power to borrow money on the credit of the United States. That’s with a capital “U” and a capital “S”, a proper noun, not the several states or the people, but the union of states known as the United States.

Not only can Congress collect taxes and borrow money, but they have the power to spend money as well.

No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law;

– U.S. Constitution, Article 1, Section 9, Clause 7

The situation we are talking about today is very simple. When Congress passes laws to appropriate money from the treasury that exceeds the amount collected in taxes, Congress must borrow the difference. I know, that seems pretty simple, but based on recent discussions, articles and press conferences, this simple fact is not only lost on Congress and the entire federal government, but on the people as well. Which is how we get reports like this:

“The federal budget deficit was $1.1 trillion in the first half of fiscal year 2023, the Congressional Budget Office estimates—$430 billion more than the shortfall recorded during the same period last year—and consistent with projections CBO released in February,” this according to the Congressional Budget Office’s Monthly Budget Review for March 2023.

The deficit, which is the difference between money spent and taxes collected, is the amount that the United States has to borrow to make up the difference. This is not to be confused with the national debt, which is the accumulations of all the deficits over time, also known as the money Congress has borrowed on the credit of the United States. How did we get to this particular situation?

“Outlays were 13 percent higher and revenues were 3 percent lower from October through March than during the same period in fiscal year 2022,” the CBO’s review went on to state.

A fiscal year is an accounting period of time. The United States runs on a fiscal year that starts on Oct. 1 every year. That means that the budget for 2023 ends on Sept. 30, 2023, rather than on Dec. 31. (It may seem a little confusing, but that explains why the Congressional Budget Office reports data starting in October rather than January.)

All this means that Congress appropriated 13% more money for the Treasury department to spend in the first half of fiscal year 2023 compared to 2022, yet the actual collection of taxes Congress authorized by law during that same time period was 3% lower than the previous year.

Just like for your home budget, if expenses go up while income goes down, then you have to borrow money to pay the bills. In the case of Congress, they just borrowed $1,100,000,000,000 on the credit of the United States. I did a little math and the $1.1 trillion dollars that Congress had to borrow will cost the American people approximately an additional $13.8 billion every year in interest payments. I don’t know about you, but that sounds like serious money to me.

The Debt Limit

While most Americans would put these budget shortfalls on their credit cards, Congress does not have a literal “American Express” card on which to charge this. The full details of how the federal government actually borrows money is beyond the scope of this article, but it’s important to know a few basic concepts. Since only Congress can borrow money on the credit of the United States, they must authorize such borrowing by law. This is commonly known as the debt limit, and can only be changed by law, meaning Congress must pass a bill and the president must sign it. Think of it as the credit limit on your credit cards. If you keep borrowing money by charging it to your credit card, sooner or later the bank will say “that’s enough.” Similarly, as the federal government keeps borrowing money to spend on its profligate programs, sooner or later the American people, through their representatives in the House, and the states through their representatives in the Senate, will also say, “That’s enough.” At least we would hope so, but that has not been the case—which is why every time in history that the federal government’s borrowing approached the debt limit, Congress simply raised it, voting to extend its own credit limit.

I don’t know about you, but if I was maxing out my credit cards every couple of years, I’d take a serious look at my budget. Sure, there are some things I can do to increase my income, but the first place I’d look is at my spending.

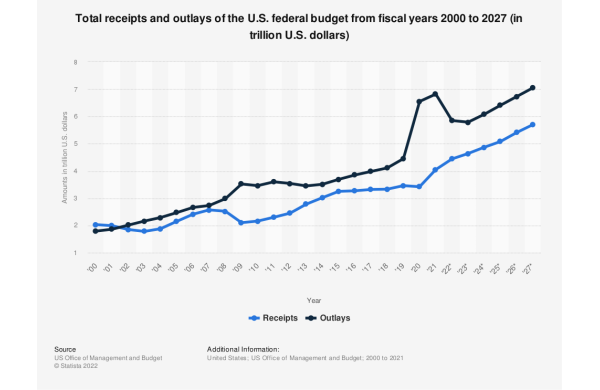

Take a look at federal receipts and outlays in the 21st Century:

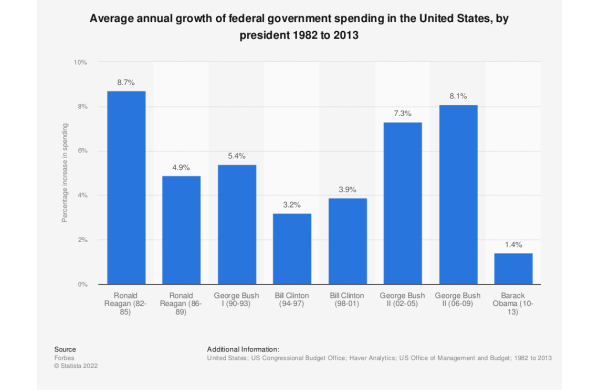

Federal spending, with rare exceptions like the end of COVID, almost always seems to go up. Yes, the revenue frequently goes up, but rarely as fast as the spending. This continuous increase in spending is nothing new; neither is it limited to a particular political party. Just look at the increase in spending under some of the more recent presidential administrations:

This latest graph shows one of the more common misunderstandings of America’s budget crisis. Presidents don’t appropriate money, Congress does. Remember Article I, Section 9, Clause 7?

No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law;

That means the people most responsible for authorizing the ever-increasing spending are the members of Congress. That also means the representatives of the people and the states are authorizing this spending. Since the people elect members to both houses of Congress, that means we are responsible for putting the people in place who have created this disaster. At the end of 2022, our national debt was just short of $31,000,000,000,000. Compare that to our gross domestic product, which is the sum of all goods and services sold in the United State in 2022, which came in at $21,461,300,000,000. That means if we took every dollar in goods and services made in the United States and applied it to the debt, we would still have almost $10 trillion of debt still outstanding. That would be like taking your entire paycheck, before taxes and deductions, and sending it to the credit card company, and still having a six-figure debt balance. Unfortunately, nothing currently going on in Congress will change any of this.

The responsibility to set a budget is not a surprise to Congress. Neither is the need for appropriations bills or the debt ceiling. The dates of these events are known to each and every congressman at the beginning of the session. Yet year after year these men and women simply wait until the last minute and then find a way to “kick the can down the road.” Not all members of Congress are this derelict in their duties, but the majority of them are. And every two years these members of Congress lie to the American people that they will fix what they see as the problem, but they never seem to propose any solutions that would actually do so. Yet the American people blindly follow these fiscally malfeasant actors down the path to destruction. This leads me to a little news article you may not have seen.

Constitutional Crisis

On ABC’s This Week, George Stephanopoulos, during an interview with Treasury Secretary Janet Yellen, repeatedly asked about calls for the White House to invoke the Fourteenth Amendment to allow the treasury to continue borrowing money even if Congress does not raise the debt ceiling. How is that supposed to work?

The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.

– U.S. Constitution, Amendment XIV, Section 4

Those who are claiming that the Executive Branch can get around Congress’ pesky debt limit problem by invoking the Fourteenth Amendment have apparently missed one or two little phrases. First, no one is questioning the debt. The question is, will Congress authorize by law additional debt? This is the second problem for those looking for a non-legislative solution. Any debts incurred outside of congressional action are not authorized by law, and therefore their validity would not be subject to the Fourteenth Amendment. Since the Constitution only delegates the power to borrow money on the credit of the United States to Congress, any attempt by the Treasury department to borrow money beyond Congress’ authorization would be void and of no effect.

An unconstitutional act is not a law; it confers no rights; it imposes no duties; it affords no protection; it creates no office; it is in legal contemplation as inoperative as though it had never been passed.

– Norton v. Shelby County, 118 U.S. 425 (1886)

So where does that leave us? With all the fingers pointing back and forth between the houses of Congress, the presidency, and the Department of Treasury, the ones truly responsible for this mess are We the People. Yes, we have hired representatives that have spent more than they collected in taxes for decades. We did so because we thought we could get goods and services from government and not have to pay for them. In short, the American people have been incredibly greedy for decades, and the chickens are coming home to roost. We asked Congress to collect taxes for more than paying the debts and providing for the common defense and the general welfare of the United States, but we asked them to appropriate far more than we would let them collect. With each new program, service, subsidy and entitlement, we told our representatives to simply charge it, figuring someone else would have to pick up the tab. Well, that game of musical chairs is coming to an end, and it appears this generation is the one without a place to sit.

The only reason the United States is not bankrupt is because people around the world keep lending us money or the Federal Reserve makes it up out of thin air, further devaluing the dollar and pushing us deeper into this fiscal crisis. Like a drunk who wards off his hangover by drinking more, we’ve kept this party going far longer than reason would allow. Someday, just like that drunk, the United States will get cut off by the world. In fact, I think it’s already starting to happen as more and more nations agree do to business together in something other than U.S. dollars. The world trusted us to be its reserve currency, and people outside the USA are starting to realize we were not up to the challenge.

Regardless of where you stand on the current debt limit issue, if We the People don’t demand that our public servants get our fiscal house in order, then our economic future is bleak indeed. For those of you who think that we can continue this charade, that we can fix this crisis without spending cuts, I remind you that we’ve tried that for at least 70 years and it hasn’t worked yet. As Mr. Albert Einstein put it: “Insanity is doing the same thing over and over again and expecting different results.”